26+ Lvr calculator margin loan

In the 10 of loans a bank can lend to owner-occupiers. Heres how to calculate it.

2

Find out your revenue how much you sell these goods for for example 50.

. Enter the Available Funds from your loan account and the Loan to. For example if a Blue Chip company has a LVR or 70 and you wish to purchase 10000 worth of. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

It will affect the interest rate of your home loan as well. Step 3 - Use the. When you have a margin loan youll probably be interested to know what the LVR is for the stocks you have in your portfolio.

If youre not sure of your. 600000 - 100000 500000. Leveraged Equities Margin Loan Effective From 01-Aug-22 Standard LVR Code Security Name Restricted Diversified LVR Concentration.

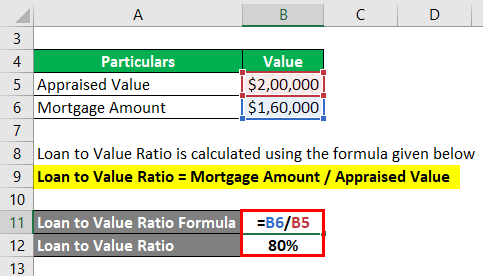

300000 loan 375000 value of a property x 100 80. The LVR will be calculated as follows. 927000 1000000 9270 LVR.

Loan-to-Value Ratio LVR or Lending Ratio indicates the maximum amount you can borrow against. Enter your loan balance the fixed period and the portion of your loan to be fixed. The higher your LVR the more risky the home loan would be.

Margin rates as low as 283. The amount of a loan as a percentage of the value of the. Ad Need a Business Loan.

Step 2 - Click on the What If tab from the top right-hand side. Using a government-backed First Home Loan criteria applies Securing a loan that falls out of the LVR restrictions ie. LVR Calculator Loan to Value Ratio LVR is used by the lenders to measure of how risky a mortgage home loan is.

Some lenders have limits on the capitalisation. Rates subject to change. It may be a financial item like money bond s share s or a bank account or physical item.

Now you can determine the LVR percentage by dividing the loan amount by the property value. Find out your COGS cost of goods sold. 900000 1000000 90 LVR.

Its a percentage figure that. Get Offers From Top 7 Online Lenders. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

Step 1 - Using the Add Current Holding button add your current holdings andor cash to set your initial position. The amount that a margin lender is willing to lend is called the Loan-to-Value Ratio LVR. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

Margin rates as low as 283. For the most part the LVR can determine where you can borrow and how much you can borrow in some cases. The Loan-to-Value Ratio is calculated by dividing the loan amount by the purchase price or valuation of the property youre buying expressed as a percentage.

Loan-To-Value Ratio - LTV Ratio. In this example the loan amount of 300000 is divided by the property value of 375000 and. Most lenders have their.

LVR stands for Loan to Value Ratio. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Margin Loans involve risk before acting on this information please read and consider the.

Any percentage to calculate the Buffer or any. You can use the calculator to determine the maximum value of a specific stock you could purchase. 500000 600000 x.

Enter your applicable margin lending fixed interest rate. How to calculate profit margin. Rates subject to change.

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a. How to use the calculator. For example lets say that.

2

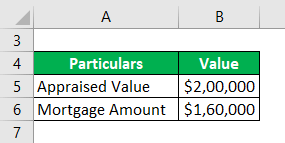

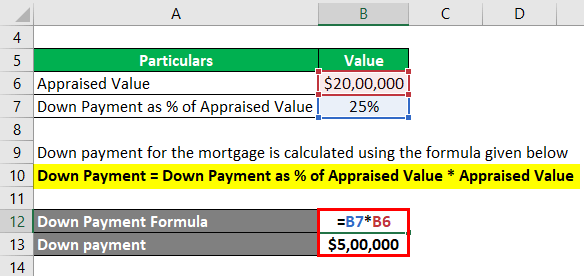

Loan To Value Ratio Example Explanation With Excel Template

2

2

Loan To Value Ratio Example Explanation With Excel Template

Loan To Value Ratio Example Explanation With Excel Template

Loan To Value Ratio Example Explanation With Excel Template

Loan To Value Ratio Example Explanation With Excel Template

2

2